Institutional framework

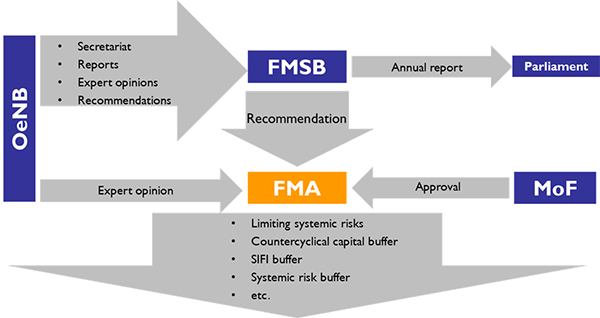

The Financial Market Authority (FMA) is the designated authority for macroprudential instruments, but the Ministry of Finance, the Financial Market Stability Board (FMSB), and the OeNB also have an explicit role in macroprudential policy setting varying between instruments.

- The FMA is designated by law (Austrian Banking Act) as the competent authority, where CRD or CRR require such a designation; i.e. according to Art. 130 (3) and 136 (1) (countercyclical capital buffer), 131 (1) (G-SII and O-SII buffer), and 133 (3) (systemic risk buffer) of Directive 2013/36/EU, and Art. 458 of Regulation (EU) No. 575/2013 (“national flexibility”).

- The aforementioned instruments are implemented by the FMA by issuing administrative regulations (“Verordnungen”). In all cases, the FMA has to get the approval of the Ministry of Finance as a final condition before enacting such administrative regulation.

- In the case of G-SII, O-SII buffer, and “national flexibility” instruments (Art. 458 CRR) the FMA shall obtain an expert opinion from the OeNB, in the case of the countercyclical capital buffer and the systemic risk buffer the FMA may obtain an expert opinion from the OeNB.

- In all of the cases the Financial Market Stability Board (FMSB) can issue a recommendation to FMA, which has to explain a non-action or any other deviations from the FMSB recommendation.

- The use of instruments under Art. 458 CRR is subject to a prior formal recommendation of the FMSB.

- The OeNB has i.a. the task to propose recommendations and risk warnings that the FMSB may issue to the FMA.